The Deputy Commissioner, Santosh Sukhadeve, who presides over the District Level Review Committee and District Consultative Committee, conducted an evaluation of banks’ performance for the initial quarter of 2024 at his office on May 24.

Lead Bank Manager, Leh, Tsering Wangmo, briefed the DC on the CD ratio, reporting that total deposits as of March 2024 amounted to Rs 5901.50 crore, compared to Rs 5637.82 crore in December 2023. She also highlighted that the total credit as of March 2024 stood at Rs 2813.48 crore, up from Rs 2795.23 crore in December 2023, indicating a credit growth of Rs 100.65 crore quarter-on-quarter. Consequently, the CD ratio for the quarter ending March 2024 witnessed a 1.91% increase.

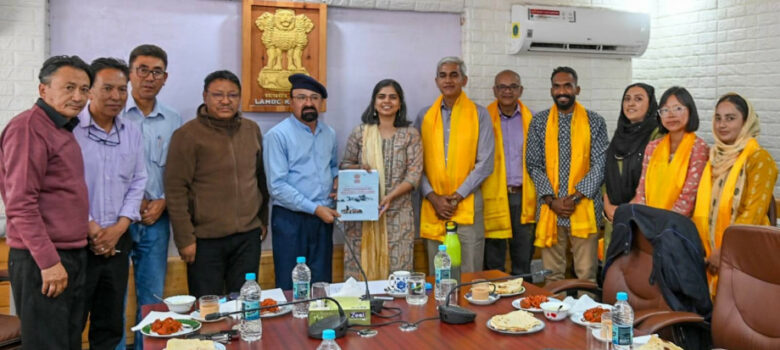

District Development Manager, NABARD, Leh, Tsewang Dorjay, presented a booklet of the Potential Linked Credit Plan 2024-25 to the DC.

The DC instructed banks to adhere to the specified targets for each bank, especially in the category of Social Security Schemes, and to achieve these targets by the next quarter. Moreover, he stressed the importance of ensuring the functionality of digital payment systems, particularly mobile applications.

He directed all banks to conduct awareness camps during the summer season and to meet their targets, taking into account the unavailability of people during the winter.

Lead District Officer (LDO), Neha Mattoo, urged banks to conduct a comprehensive review of the Potential Linked Credit Plan. She also encouraged banks to voice their concerns so that solutions could be devised during the quarterly meeting itself.

The meeting scrutinized the performance of banks under various sectors, including priority and non-priority sectors further segmented into sub-sectors such as agriculture, agriculture infrastructure, MSME, education, housing, social infrastructure, renewable energy, and others.

The performance of banks under various government-sponsored schemes like Pradhan Mantri Employment Generation Programme and Kisan Credit Card was also assessed.

Representatives of the CRISIL Foundation, operating the Centers for Financial Literacy (CFL), discussed the centers they’ve established in various blocks and requested banks to collaborate with them during field visits.

The meeting was attended by ADDC, Leh, Sonam Nurboo, along with bank branch heads and representatives from the 18 public and private banks operating in Leh district.